What is the Alpha-Elite Allocation Engine?

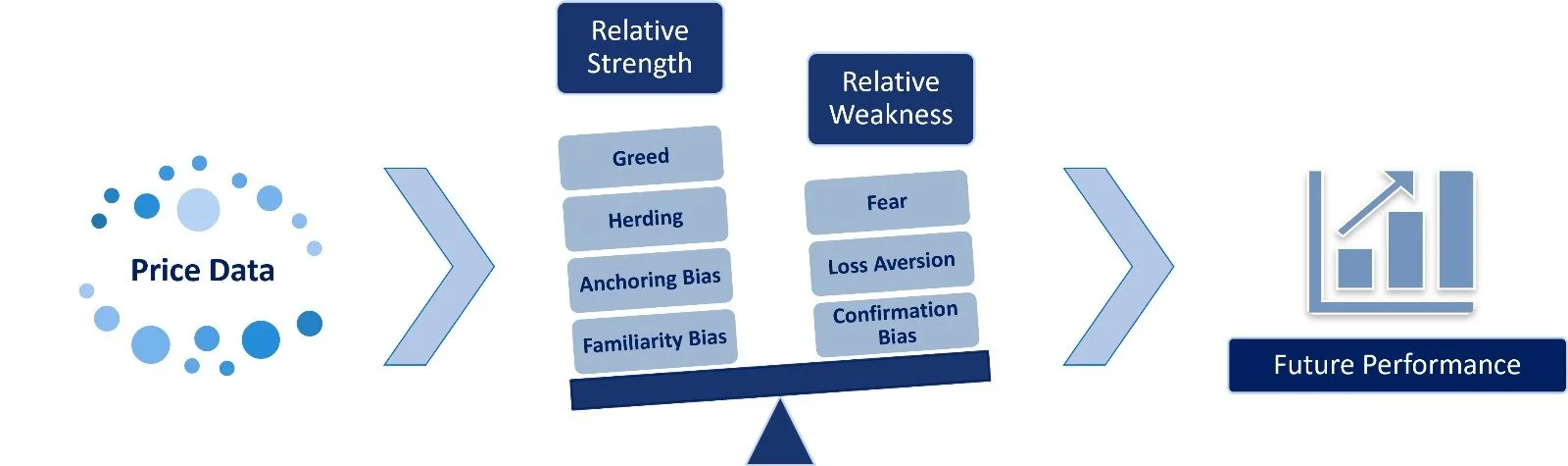

A highly sophisticated and completely unique quantitative algorithmic system for selecting momentum stocks

based on behavioural science.

Behavioural finance in relation to stocks can be quantified to identify those stocks with the highest probability of future performance. This is in essence what the Alpha-Elite Allocation Engine does.

Why Quantitative Momentum?

Quantitative or systematic momentum is an approach which avoids the pitfalls associated with discretionary investment management.

No fundamental analysis is involved: all information is already captured in the price behaviour of a stock.

The Alpha-Elite Allocation Engine uses proprietary metrics to identify very specific behaviour characteristics hidden in price data.

This allows us to rank individual stocks from best to worst.

Alpha-Elite and the Vortex Indicator

We have made a breakthrough discovery of using the Vortex Indicator, invented by one of Alpha-Elite’s founders.

The original Vortex Indicator has been enhanced and transformed into a proprietary metric within the Alpha-Elite Allocation Engine. This gives Alpha-Elite a unique edge for choosing the best momentum stocks.

The original Vortex Indicator was invented in 2004 by Etienne Botes, one of Alpha-Elite’s founders, and published in 2010. Today the Vortex Indicator is used around the world by banks, news agencies, trading platforms and other hedge funds. Here is a small sample: