September 9, 2025.

This is not a stock chart

A lesson in financial markets by René Magritte.

My partner, Christian - an art connoisseur with a sharp eye for metaphor, recently sent me an image of René Magritte’s famous painting: The Treachery of Images.

Most will recognize it immediately. It’s the simple depiction of a pipe with the words “Ceci n’est pas une pipe” (“This is not a pipe”) written beneath.

At first glance, it seems like a joke. Of course it’s a pipe. But Magritte’s point was subtle and profound: we are not looking at a pipe, but at a picture of a pipe. A representation, not the thing itself.

Finance as Representation

This distinction between reality and representation is not confined to the world of art. It is central to the world of finance.

When we look at a price chart of Nvidia—or any company—we are not seeing the company itself.

We are not seeing semiconductors, earnings reports, or balance sheets. What we see is a graphical imprint of human behaviour. It is a chart of people—their hopes, fears, greed, optimism, pessimism, and herd instincts—aggregated into price action.

Price Behaviour, Not Companies

In this light, price behaviour takes on a new dimension. Every rise or fall in the market is not simply a reflection of fundamentals, but of how thousands of participants collectively perceive and react to information.

These behavioural patterns repeat because human psychology repeats. Prices move in cycles of fear and greed, confidence and doubt, euphoria and despair.

The Role of Fundamentals

Does this mean fundamental analysis is irrelevant? Not at all. Investors like Warren Buffett have built fortunes on the disciplined study of fundamentals. But as we often point out, Buffett’s success is inseparable from his time horizon—he can afford to hold forever—and from the resources of an army of analysts working behind him.

For the rest of us, the reality is different. Even the most rigorous fundamental analysis eventually expresses itself through human behaviour—because analysts, portfolio managers, and retail investors alike must make buy and sell decisions. And when they act, those decisions show up in price behaviour.

Why Behavioural Finance Matters

This is why behavioural finance is so powerful, yet still underappreciated. Prices are not cold reflections of fundamentals: they are living expressions of perception. In the short to medium term, perception frequently trumps reality. Herding behaviour, fear of missing out (FOMO), and irrational exuberance can inflate prices well beyond reason—as history reminds us, from Dutch tulips to dot-com stocks to housing bubbles.

Momentum as Financial Behaviour

Momentum investing—the cornerstone of our approach at Alpha-Elite—sits precisely at this intersection.

Momentum is nothing more than the systematic measurement of financial behaviour over time.

It captures the persistence of human reactions: fear giving way to capitulation, optimism giving way to overconfidence. That is why momentum is, empirically, one of the most successful strategies in finance.

Guarding Against the Crowd

But momentum must be used with care. Just as crowds can be rational, they can also be disastrously wrong. Herding can drive bubbles, and bubbles can burst.

At Alpha-Elite, we take steps to reduce these risks: focusing on large-cap stocks, rebalancing monthly, and deploying our proprietary Allocation Engine.

This engine uses seven carefully designed metrics to analyse daily price behaviour over several months, “sniffing out” authentic momentum while filtering out irrational excess.

A Final Reflection

Ultimately, the insight is both simple and profound: price charts are not about companies—they are about people.

Every movement is the sum of human judgment, emotion, and behaviour. If you can read that behaviour, you can invest not only in stocks, but in the psychology of markets themselves.

As Magritte might have said: “This is not a stock chart.”

It is a portrait of all of us, as market participants, whose collective decisions create the picture we see.

August 11, 2025.

The Market That Refuses Logic

Why the world’s most unloved bull market might be the best argument for disciplined investing.

An Unstoppable Rally — Or Just an Unexplained One?

In the last five years, the U.S. stock market has shrugged off a pandemic, the worst inflation in 40 years, interest rates at 20-year highs, and a set of economic policies from Washington that most economists consider — to put it politely — counterproductive.

From 2019 to 2024, the S&P 500 grew at nearly twice its historical average. In 2025, it’s already up about 8%, despite tariffs at century highs, labour shortages, fiscal uncertainty, and a debt ceiling drama lurking in the background.

The dissonance is striking: bad headlines, good markets.

Theories, Theories Everywhere

Over the past few years, market watchers have cycled through a rotating cast of explanations. Each sounds compelling — until reality changes the plot:

The Fundamentals Story

Stocks reflect future earnings, they said. Except corporate earnings growth hasn’t been spectacular enough to explain valuations at these levels.The Liquidity Story

Easy money from the Fed lifted all boats after 2008 and during COVID. But since 2022, the Fed has drained liquidity and hiked rates — and yet, markets surged anyway.The AI Narrative

The “Magnificent Seven” mega-caps have delivered eye-watering gains on the back of the AI revolution. Nvidia’s valuation alone defies conventional math. Is this transformative innovation — or 1999 with better branding?The TACO Trade (Trump Always Chickens Out)

The idea: fade every tariff threat, because policy will be watered down to spare the market. Trouble is, tariffs are in fact at record levels, and still the market marches higher.The Passive Investing Effect

With half of U.S. fund assets now in passive vehicles, index buying is relentless. That mechanical demand pushes valuations higher, concentrates capital in the largest companies, and dampens the market’s sensitivity to bad news.

Each theory explains part of the picture. None explains all of it.

Bad Policy, Strong Market

Economists almost universally agree: the current administration’s trade and budget policies are a long-term drag on growth. Tariffs, deportation-driven labour shortages, and deep cuts to research funding are not recipes for lasting prosperity.

And yet… the immediate GDP hit from even aggressive protectionism is modest. Yale’s Budget Lab estimates a long-run drag of 0.4% — meaningful, but hardly catastrophic in the short term. Meanwhile, the AI buildout is turbocharging capital investment, propping up growth that might otherwise have stalled.

It’s not that the market is ignoring bad policy — it’s that short-term optimism about AI is overpowering medium-term concerns.

The Unloved Bull

If this were a textbook bull market, you’d expect widespread enthusiasm. Instead, scepticism is everywhere:

Short interest in major ETFs is rising.

Hedge fund leverage is below average.

Leveraged long funds are seeing outflows, while inverse products gain assets.

Consumer sentiment is near historic lows.

And yet, every sharp pullback has been followed by a sharper rebound. The bears keep stepping in front of the proverbial steamroller — and the steamroller keeps winning.

When Even the Experts Can’t Agree

What do you do when fundamentals don’t align with prices, liquidity isn’t the driver, and the dominant market story might be a bubble in disguise?

You could try to pick the right narrative, time the inevitable correction, and position accordingly. But history suggests that even the most experienced professionals, with armies of analysts and data models, tend to get this wrong more often than right.

It would appear that pessimism is increasingly a permanent psychological bias in human financial behaviour. Bad news gets more attention than good news because pessimism is often wrapped in intellectually profound analysis, while optimism can seem simplistic.

Even in publishing, books about economic doom and disaster far outsell those about optimism and market growth — bad news sells.

Paul Samuelson once joked that the stock market had predicted nine of the last five recessions. That was true then, and it’s truer now.

Our Take: Process Over Prediction

At Alpha-Elite, we don’t pretend to know whether the AI boom will keep going, whether tariffs will trigger a recession, or whether the Magnificent Seven will become the next Nifty Fifty.

We don’t try to divine the market’s mood — because moods can change faster than policy, and faster than portfolios can react.

Instead, we rely on our Alpha-Elite Allocation Engine:

Systematic: Every month, it selects the 10 stocks with the strongest momentum characteristics.

Unemotional: No macro guesswork, no gut feel, no “what if” paralysis.

Empirical: The process is grounded in years of rigorous testing and performance data.

We believe — and have demonstrated — that disciplined, rules-based investing outperforms over the long term, not because it predicts the market’s reasoning, but because it sidesteps the temptation to try.

Final Word

Let’s be clear: we are not suffering from “irrational exuberance” in the stock market. We are not chronic optimists about the enduring bull-bias in equities. We are not in self-denial about the existence and inevitability of bear markets.

But we are absolutely against the notion — so often embraced by chronic pessimists — that second-guessing the stock market is a viable strategy. Too many investors miss out on strong returns in a vain attempt to time the market.

Markets don’t have to make sense for them to make money.

What matters for serious investors is not why the market is going up, but how to capture its gains without falling prey to the seductive but dangerous game of over-explanation.

In an era where the market refuses to listen to conventional wisdom, perhaps the wisest move is not to talk — but to act, with discipline.

Author’s note: The events described in this article may be specific to this moment in history — however, the results and conclusions about financial behaviour will happen again, and again, and again.

References

Edwards, J. (2022) Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull Markets. Hoboken, NJ: Wiley.

Budget Lab at Yale. 2025. State of U.S. Tariffs: August 7, 2025. [online] Available at: https://budgetlab.yale.edu/research/state-us-tariffs-august-7-2025 (Accessed 10 Aug. 2025)

Bloomberg News (2025) ‘Battered Wall Street “short brigade” is refusing to admit defeat’, Bloomberg, 16 May. Available at: https://www.bloomberg.com/news/articles/2025-05-16/battered-wall-street-short-brigade-is-refusing-to-admit-defeat (Accessed: 10 August 2025).

Thompson, D. (2025) ‘The search for stock market theories that actually explain something’, The Atlantic, 5 August. Available at: https://www.theatlantic.com/economy/archive/2025/08/stock-market-theories/683780/ (Accessed: 10 August 2025).

Krugman, P. (2025) ‘About that stock market’, Paul Krugman | Substack, 8 August. Available at: https://paulkrugman.substack.com/p/about-that-stock-market (Accessed: 10 August 2025).

July 24, 2025.

Momentum Myth Busting: Transaction Costs

When you pause and reflect, it’s actually quite extraordinary to have lived through the last few decades in the financial markets. Because thanks to relentless innovation and technology, everything feels new—almost like we're only at the start of a new era in finance.

This sense of novelty extends even to our own core investment philosophy: momentum investing.

A Quick Refresher: What Is Momentum Investing?

Momentum investing is a remarkably logical idea: stocks that have outperformed their peers (the “winners”) tend to keep outperforming. It’s the simple tendency for assets in motion to stay in motion—until they don’t.

Despite the momentum effect being present for over a century, it wasn’t until a landmark academic paper in 1993* that the concept received proper recognition. That paper opened the floodgates: over the ensuing decades, a vast body of academic research has confirmed the superiority of momentum over many other investment styles.

Naturally, as night follows day, some academics pushed back against the outperformance of momentum investing—on the grounds of transaction costs.

The Academic Debate: Does Momentum Fall Apart Under Trading Costs?

Critics argue that high turnover makes momentum investing fragile. Because momentum managers frequently refresh their portfolios—selling stale trades and rotating into newly strong names—they rack up trading costs. These costs, the argument goes, can erode or even eliminate any edge momentum has over simply investing in the index.*

But here’s the beauty of peer-reviewed research: every paper has a counter-paper.

Another growing camp of academics insists this fear is outdated. Yes, in the “good old days” when a round trip cost 1.7–2%, momentum's advantage might have been wiped out. But today? Institutional trading fees are often as low as 0.1–0.2%. And thanks to smart execution techniques and vastly improved liquidity, those costs are far less destructive.*

Here's the Real Question

Rather than asking whether momentum as a concept is vulnerable to trading costs, the real question should be:

How vulnerable is the implementation of a specific momentum strategy to transaction costs?

And to be perfectly honest, that's the whole point of this blog post—to demonstrate how utterly pointless the theoretical debate over transaction costs can be when viewed in the context of an actual, real-world strategy.

Let’s Look at the Alpha-Elite Momentum Strategy

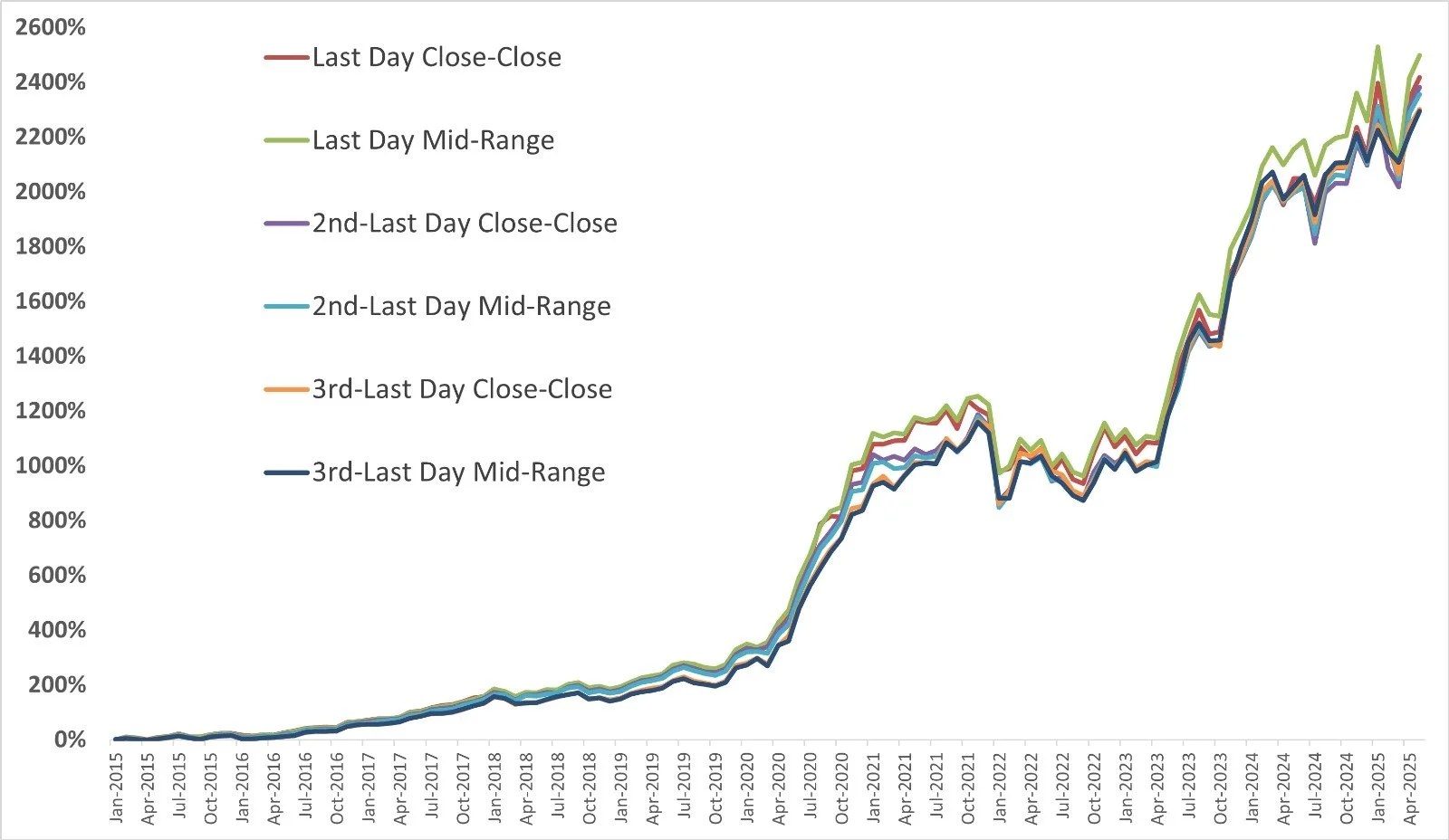

Graph 1: Our Momentum Strategy — Clean and Simple

Take a look at Graph 1. This represents the performance of the Alpha-Elite U.S. strategy, which draws from a universe of Nasdaq-100 and S&P 100 stocks. Our system selects just five stocks per month.

Graph 1.

The results are based on the closing prices on the last day of each month—an idealized reference point, yes, but a necessary one. And while you might argue that such precision is unrealistic in practice, it's more relevant than you might think: most trading volume—and thus liquidity—occurs near the close.

But even if you disagree, stay with me. Because this is where it gets interesting.

Graph 2: What Happens When We Include Transaction Costs?

In Graph 2, we apply a blanket 20 basis point round-trip trading cost to our strategy. Unsurprisingly, the performance drops by about 2.4% per year. That's the most obvious and dumb analysis one can possibly do.

But here’s the thing: this is not how trading works in real life.

Graph 2.

Real World vs. Theory: The Monster Beverage Example

Let’s say we’re buying Monster Beverage Corp [MNST] at the end of June 2025.

The closing price was $62.64

Add a 0.1% fee → effective price: $62.70

But what if the stock had been bought just 15 minutes earlier? Then the price might have been $62.58 → effective price including fees: $62.64

Or maybe it was bought at the high of that bar: $62.67 → effective with fees: $62.73

MNST 15-minute chart

The point? Execution timing matters more than the 0.1% fee. In many cases, the fee becomes noise.

How Robust Is Our Strategy to Timing?

Graph 3: Sensitivity Analysis

To test the robustness of our monthly portfolio rebalancing strategy, we simulated different entry and exit scenarios.

In the first test, we assumed each stock was bought at the closing price on the last day of the month and sold at the closing price on the last day of the following month.

We then ran additional simulations using the closing prices from the second-last and third-last trading days of each month. For each of these scenarios, we also tested using the mid-range price, calculated as the average of the day’s high and low prices.

Graph 3.

The result? All equity curves looked nearly identical. That tells us something powerful: our strategy is not sensitive to small timing or cost variations. It’s robust. It holds up.

We Go Further to Reduce Friction

Our design decisions intentionally reduce cost exposure:

We trade only large- and mega-cap equities in the U.S. and Europe. Mid-cap and small-cap stocks have higher trading costs

We avoid short selling, which adds cost and complexity

We don’t fully change our stocks every month—stocks can and often do persist in the portfolio across multiple periods

Why Do People Still Obsess Over Fees?

If transaction costs aren’t such a big deal, why do people still focus so much on them?

1. Retail Psychology and Marketing

"Zero-commission" trading is easy to market. Platforms like Robinhood have gamified trading and advertised "free" investing. For individual investors, brokerage fees are tangible and visible, while price slippage is less obvious. Sometimes, it's just legacy thinking — people still talk about fees because it used to matter more when commissions were 1–2% per trade (before the 2000s).

2. High-Frequency Traders

For market makers and HFTs making millions of trades, tiny costs matter. They have to optimize every basis point to survive. They obsess over microscopic costs because it directly affects their statistical edge.

3. Mutual Funds and Large ETFs

Large mega-funds running momentum strategies often scrape out a small edge over the benchmark. For them, even small costs can matter because their relative advantage is small to begin with.

Final Thoughts: Don’t Worry About the 0.1%

Yes, it’s prudent for any portfolio manager to negotiate the lowest trading fees possible. But here’s what matters more:

Can the strategy withstand variations in execution, price and cost? Or does it fall apart if a trade is delayed or the fee is slightly higher?

If the answer is the latter, the strategy is fragile—and that’s a much bigger concern than 0.1%.

We’ve tested and retested our approach, and the conclusion is clear: our strategy remains strong regardless of small changes in cost or timing.

* References

Hoffstein, C., 2018. Two centuries of momentum. Newfound Research.

Hurst, B., Ooi, Y.H. and Pedersen, L.H., 2017. A century of evidence on trend-following investing. The Journal of Portfolio Management, 44(1), pp. 15-29.

Dennehy, B., 2021. The history of momentum investing – Two centuries of pedigree.

Geczy, C.C. and Samonov, M., 2016. Two centuries of price-return momentum. Financial Analysts Journal, 72(5), pp. 32-56.

Jegadeesh, N. and Titman, S., 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), pp. 65-91.

Korajczyk, R.A. and Sadka, R., 2004. Are momentum profits robust to trading costs? The Journal of Finance, 59(3), pp. 1039-1082.

Lesmond, D.A., Schill, M.J. and Zhou, C., 2004. The illusory nature of momentum profits. Journal of Financial Economics, 71(2), pp. 349-380.

Agyei-Ampomah, S., 2006. The post-cost profitability of momentum trading strategies: Evidence from the UK. Journal of Business Finance & Accounting, 34(1-2), pp. 141-167.

Asness, C.S., Frazzini, A., Israel, R. and Moskowitz, T.J., 2014. Fact, fiction, and momentum investing. The Journal of Portfolio Management, 40(5), pp. 75-92.

Frazzini, A., Israel, R. and Moskowitz, T'Connor, J., 2015. Implementing momentum: What have we learned? AQR Capital Management.

SGH/EAM Investors, 2015. Momentum and trading costs.

Israel, R., Moskowitz, T.J., Ross, S.A. and Serban, L., 2017. The costs of implementing momentum strategies. Alpha Architect.

Korajczyk, R.A. and Sadka, R., 2004. Are momentum profits robust to trading costs? The Journal of Finance, 59(3), pp. 1039-1082.

June 20, 2025.

The Research That Changed Everything: The Absolute Proof

We don’t just see ourselves as fund managers — we think of ourselves more as scientists of the financial markets. No, we’re not “scientists” in the strict sense, but we are constantly immersed in the scientific method.

Because of that mindset, we rarely fall off our chairs from a surprise finding.

But this research came close.

When you manage client capital, you have to be certain you're doing the right thing. And if you’re anything like us (slightly obsessive), you're constantly checking, verifying, and retesting your assumptions — that nagging feeling that you might have missed something never quite goes away. You must always question your own findings.

Don’t worry, this is not what our office looks like, but you get the idea about being “obsessive”.

A Quick Recap: We’re Momentum Investors

Let’s start with the basics: our strategy falls squarely within the realm of momentum investing.

A reminder: momentum is the remarkably logical phenomenon that stocks which have performed well relative to peers (winners) will generally continue to outperform. It is the tendency of stocks to continue to trend in the same direction once they are in motion.

There is a mountain of research from both the industry and academia proving that momentum exists — across all markets, over centuries, and in every major country. (By the way, we’ve compiled an entire library on this site linking to momentum research.)

But even with all that, we still had to ask: What if we tested it our way? This simple research we’ve done some years ago may be the most definitive proof we’ve ever seen that momentum is real.

This might be our most important blog post. Get ready to have your mind blown.

Step One: Start With the Nasdaq 100

Let’s keep it simple. We’ll use the Nasdaq-100 as our stock universe for this experiment. We use both the Nasdaq-100 and the S&P 100 in our system — but for this experiment, you could use almost any major stock index.

A quick reminder: the Nasdaq-100 is already a form of momentum system in disguise — because stocks get added to it based on their growing market capitalisation. In other words, to even make the list, a stock already has to have been going up, and up, and up. So we’re selecting from a group of thoroughbred racehorses.

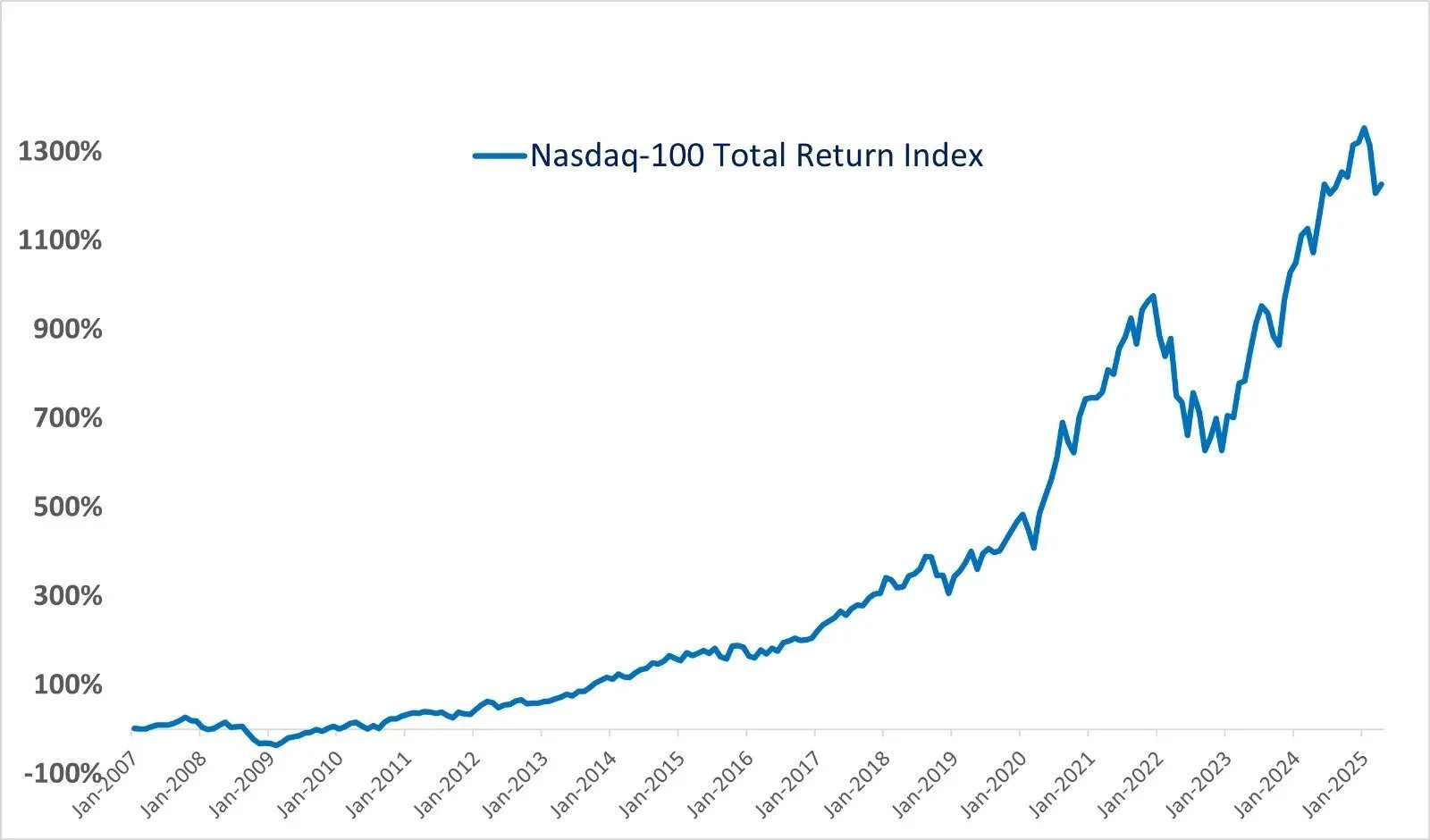

Figure 1 shows the Nasdaq-100 from 2007 to date. Not bad as an investment, right? (Don’t tell the hedge fund industry this, but if you simply bought a Nasdaq-100 ETF like the QQQ in 2007, you would have outperformed the majority of hedge funds. I kid you not.)

Figure 1.

Step Two: The Random 5

Have you heard the classic Wall Street quip that goes something like this:

“A monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one picked by the experts.”

So, we tested what happens if you simply pick five random stocks each month from the universe of Nasdaq-100 stocks — literally random, selected by formula, not by us.

We also used the most recent month’s daily volatility to weight each of the five stocks: more capital to low-volatility names, less to the high-volatility ones. This is exactly the approach we use at Alpha-Elite.

And guess what? Even random stocks produced decent outcomes. Why? Because we’re picking from the cream of the crop. Random selection still works — when your universe is elite.

Figure 2 shows the results of this “Random 5” strategy. This shows the results of 10 tests. Please note, the Nasdaq-100 still performs really well, purely because the index is weighted in favour of the largest stocks, which gives it the extra “boost”.

Figure 2.

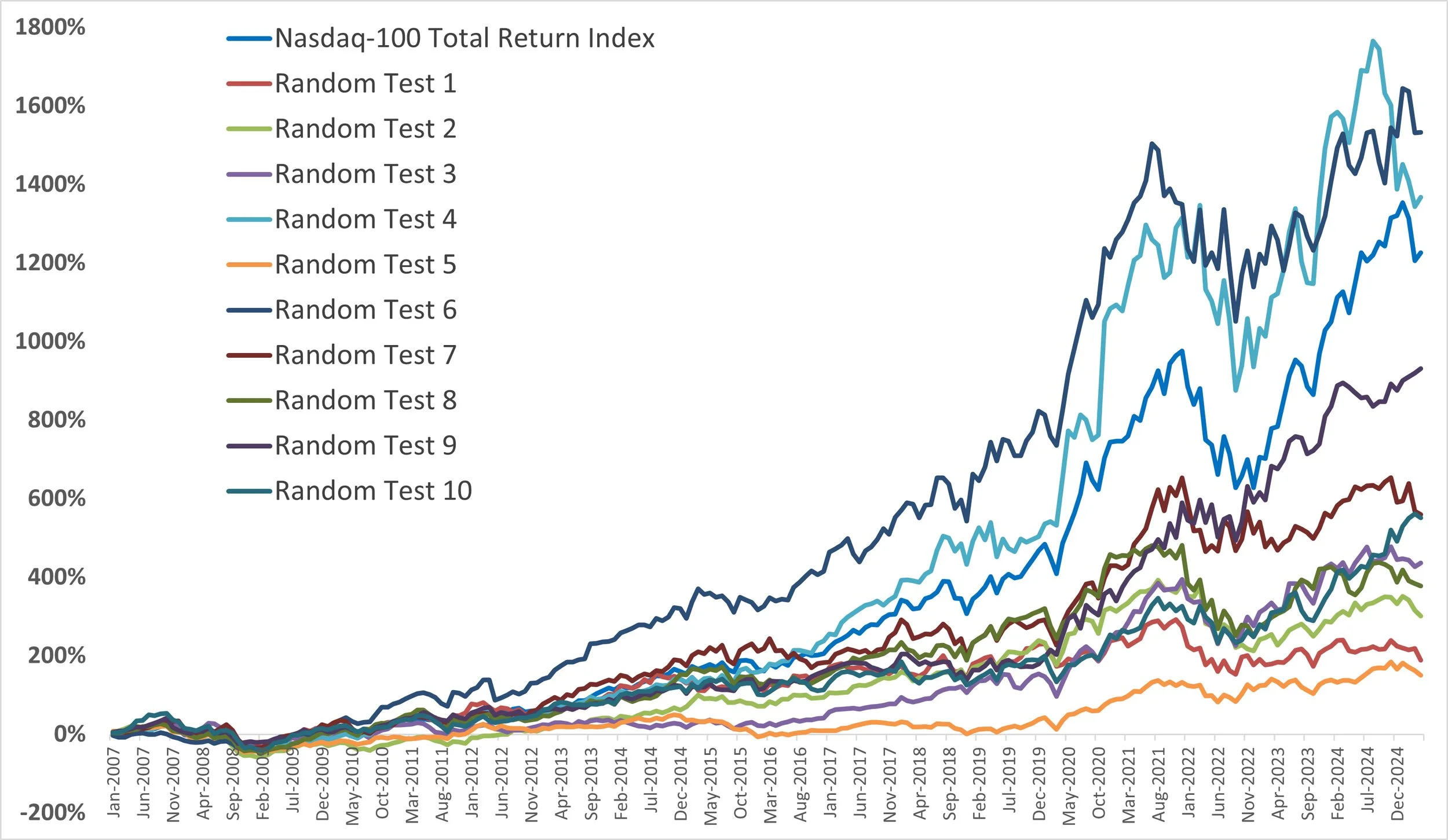

Step Three: Traditional Momentum

Now, here’s how most of the industry and academia define a basic momentum strategy: simply use the total return (performance) of each stock over the past 6, 9, or 12 months, rank the stocks from best to worst, and select the top performers in a monthly or quarterly rebalance. That’s it.

For this test, we once again used the universe of Nasdaq-100 stocks. We applied a 6-month lookback to rank stocks purely on total return for each stock and — just like before — allocated money based on the previous month’s daily volatility.

Figure 3 shows the results using this very simple, very generic “total return” metric. And yes — it doesn’t just mildly outperform the random portfolios and the index… it crushes them.

Figure 3.

If you’re a researcher, this is already a WOW moment. This alone proves, without question, that momentum is real. It also shows how easily the traditional hedge fund world can be challenged.

But it gets even better.

Step Four: Our Metrics — The Real Edge

Years ago, when we set out to build a stock selection strategy that could consistently outperform the market over the long term, we leaned heavily on creativity and lateral thinking. We built metrics using nothing but price data: daily highs, lows, closes, and volume — across the previous six months. These metrics don’t exist in the rest of the fund management industry.

We got great results early on. But here’s the wild part: we didn’t even realise we had built an advanced momentum system that was capturing core aspects of behavioural finance. We didn’t fully grasp it ourselves at first!

Only after diving deep into academic research and reading every book and paper we could find did we realise:

a) Momentum investing is a well-studied phenomenon, and

b) Other researchers had uncovered similar financial behaviour to what we’d found on our own.

It was both exciting and strange — like inventing something and only later learning it already has a name. Except, we do it differently:

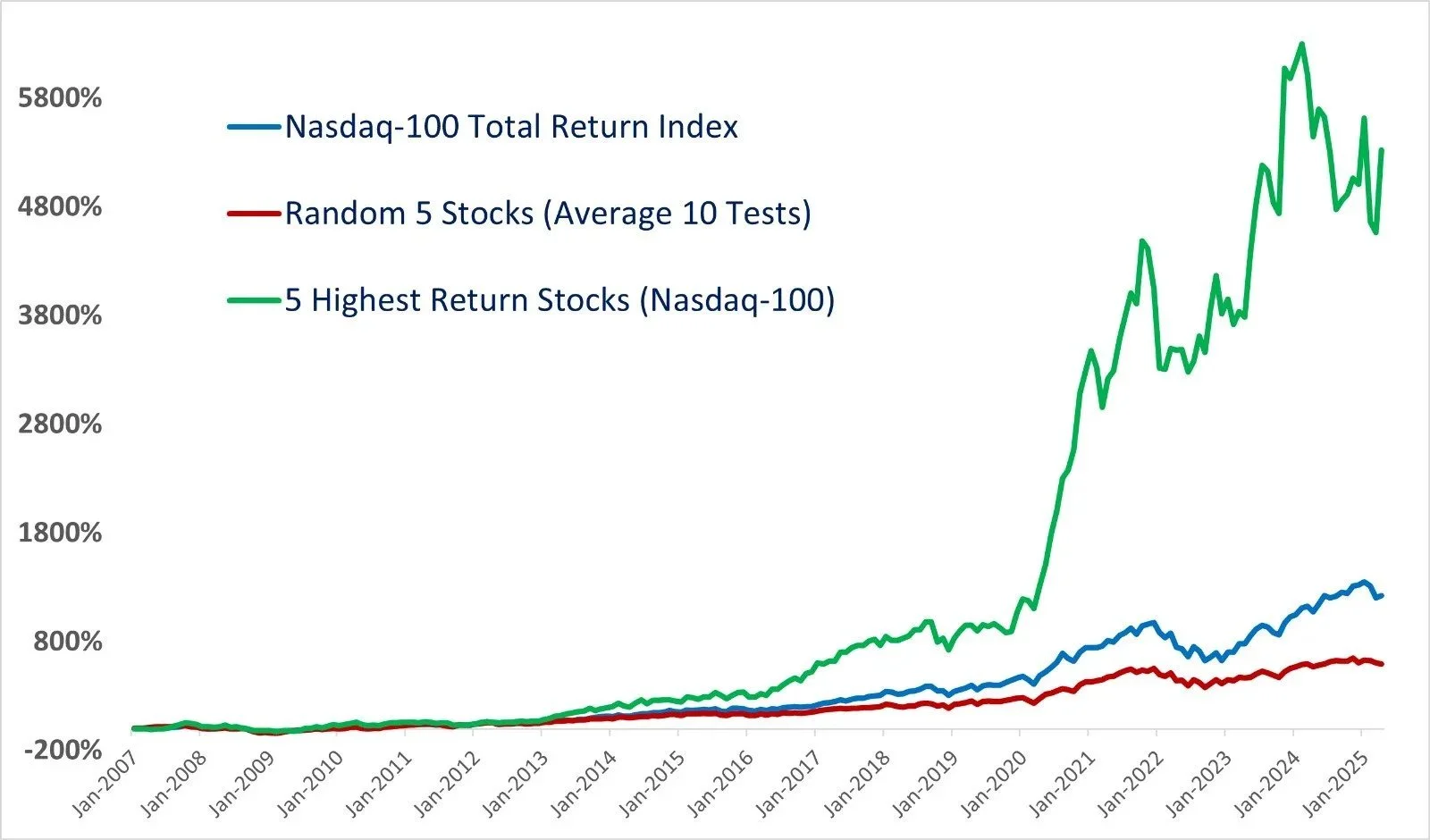

The Super Seven

After years of refinement and evolution, we now use seven proprietary metrics that are far superior to basic total return in identifying momentum. These metrics allow us to uncover investor psychology, conviction, trend strength, and structural inefficiencies in the market — all through price data alone.

That’s... uh... Figure 4. It simply dwarfs the other graphs.

Figure 4.

And yes, before you ask: it works on the S&P 100, on European index stocks, on Canadian, Australian, or any other index — it works everywhere. The result is always the same.

It works well on a 4, 5, 6, 7, 8-month lookback and even longer (so we did not curve-fit it) — but it works especially well with a 6-month lookback. Our hypothesis is that 3 and 4 months are too short, and anything longer than 9 months is too long.

Final Thoughts: The Proof Is Here

Now you understand why I called this our most important blog post ever.

We don’t want to shout this from the rooftops — but if you’re a current or future investor, this should be the ultimate proof.

But — to emphasise — all of this works over the long term. We don’t always outperform the index in the short run, but over the long term is where the real magic happens.

It’s what gives us the confidence to say — loudly, clearly, and without doubt:

It works. It works. It works.

June 7, 2025.

The Stock Market Might Be Rigged — In Your Favour

It may surprise you how many traders and fund managers have a history or hobby involving games of chance—blackjack, poker, even roulette.

Some have done exceptionally well. But let’s be clear: there is a vast difference between gambling and professional fund management.

Still, what draws many quantitatively-minded investors to both is the common thread: statistics, probabilities, and identifying inefficiencies.

From the Casino Floor to Wall Street

Names like Ed Thorp, Bill Benter, Blair Hull, David E. Shaw, Jim Simons and Nassim Nicholas Taleb all illustrate the fascinating overlap between gambling strategy and quantitative finance. Many of these figures either came from professional gambling backgrounds or applied gambling-related statistical models to financial markets.

Imagine walking into a casino where the blackjack shoe has an unusually high number of face cards—or discovering a roulette wheel biased just enough to favour a specific number sector. These small statistical edges can be exploited over time.

That is precisely the mindset we apply at Alpha-Elite. While our system is far more sophisticated than a game of cards, our approach is driven by stacking the odds relentlessly in our favour—before we even deploy our core quantitative model.

This thinking isn't just theoretical; it’s something any serious investor can apply.

1. Stocks Already Offer a Statistical Edge

We begin with a basic but powerful observation: equities have outperformed every other major asset class over the long term—be it gold, silver, commodities, real estate, currencies or even bonds.

According to historical data, global equities have delivered real returns in the range of 6–7% annually over the last century. Simply choosing to invest in stocks already places the investor on the statistically favourable side of the ledger.

2. Equities Have a Built-In Bull Market Bias

Unlike commodity or currency markets—where supply and demand can push prices in either direction—the stock market benefits from a long-term structural bias to the upside.

Why? Because equities represent ownership in companies with a mission to grow: revenues, profits, customer bases, product lines. More importantly, the market is underpinned by mandatory, recurring buying from:

Pension and retirement funds

Endowments

Sovereign wealth funds

Insurance companies

Index-tracking ETFs and mutual funds

Trusts and fiduciary managers

These massive, non-speculative inflows contribute to a consistent upward drift over time—despite short-term volatility.

3. Developed Markets: The Historical Outperformers

While emerging markets may offer the illusion of diversification and growth potential, historical data shows that developed markets—especially the US and Europe—have consistently outperformed on both return and risk-adjusted bases.

Moreover, globalisation has led to higher correlation among global markets. Diversifying into emerging markets no longer delivers the uncorrelated benefits it once did.

Thus, focusing our exposure on the most stable, proven equity markets further tilts the odds in our favour.

4. Size Matters: Why Large Caps Win More Often

While it’s tempting to chase meteoric returns from small-cap and mid-cap stocks, long-term evidence favours large-cap stocks.

These companies are generally more stable, liquid, and resilient—especially during downturns.

Large Caps tend to benefit from scale, access to capital, strong corporate governance, and brand strength. Over time, they provide a superior risk-adjusted return with lower volatility.

At Alpha-Elite, we deliberately invest only in Large Caps to reduce fragility and increase reliability of returns.

5. Then We Add Momentum and Conviction

Even before we apply our core strategy—monthly momentum-based selection—we’ve already stacked a series of statistical edges in our favour:

Asset class (equities)

Structural market inflows (pension and institutional demand)

Market selection (developed)

Capitalisation bias (Large Cap)

To this, we add:

Momentum: Riding trends backed by real money flows and investor behaviour

Concentration: Investing in a select group of high-conviction stocks rather than diluting our edge across a sprawling portfolio

The result: a repeatable, robust system that behaves like a probability machine.

The Caveat: It’s not that easy

Now, let’s not be seduced by the metaphor. Just because the market might be rigged in your favour, doesn’t mean success is easy or guaranteed.

To turn odds into results, you still need:

A long-term time horizon

Sound risk management and capital allocations

Psychological resilience, especially during drawdowns

Discipline and consistency

Without these core principles, even the most statistically favourable system can fail.

The house edge only works when you stay in the game long enough.

References

Carlson, Ben. "Historical Returns for Stocks, Bonds, Cash, Real Estate and Gold." A Wealth of Common Sense, 2 January 2025.

Silverhall Wealth. "Long-Run Asset Returns: A Deep Dive into Historical Real and Nominal Returns." Silverhall Wealth.

Cambridge Judge Business School. "Report: Stocks Have Far Outperformed Over the Past 125 Years." Cambridge Judge Business School, 2025.

Bessembinder, H. (2018). "Do Stocks Outperform Treasury Bills?" Journal of Financial Economics, 129(3), 440–457.

Siegel, J. J. (2014). Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies (5th ed.). McGraw-Hill.

Gompers, P. A., & Metrick, A. (2001). "Institutional Investors and Equity Prices." The Quarterly Journal of Economics, 116(1), 229–259.

Sushko, V., & Turner, G. (2018). "The Implications of Passive Investing for Securities Markets." BIS Quarterly Review, March 2018.

Hirshleifer, D. (2001). "Investor Psychology and Asset Pricing." The Journal of Finance, 56(4), 1533–1597.

Malkiel, B. G. (2003). "The Efficient Market Hypothesis and Its Critics." Journal of Economic Perspectives, 17(1), 59–82.

Dimson, E., Marsh, P., & Staunton, M. (2023). "Global Investment Returns Yearbook 2023." Credit Suisse Research Institute.

Fama, E. F., & French, K. R. (2012). "Size, Value, and Momentum in International Stock Returns." Journal of Financial Economics, 105(3), 457–472.

Bekaert, G., Hodrick, R. J., & Zhang, X. (2009). "International Stock Return Comovements." The Journal of Finance, 64(6), 2591–2626.

Forbes, K. J., & Rigobon, R. (2002). "No Contagion, Only Interdependence: Measuring Stock Market Comovements." The Journal of Finance, 57(5), 2223–2261.

Goetzmann, W. N., Li, L., & Rouwenhorst, K. G. (2005). "Long-Term Global Market Correlations." The Journal of Business, 78(1), 1–38.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). "The Cross-Section of Volatility and Expected Returns." The Journal of Finance, 61(1), 259–299.

Ibbotson, R. G., & Idzorek, T. M. (2014). "Dimensions of Popularity." The Journal of Portfolio Management, 40(5), 68–77.

Chordia, T., Roll, R., & Subrahmanyam, A. (2001). "Market Liquidity and Trading Activity." The Journal of Finance, 56(2), 501–530.

May 26, 2025.

Crypto: The Cult of Digital Nothingness

It might seem strange — even contrarian — to publish a piece critiquing cryptocurrencies in the very week that Bitcoin has reached all-time highs. To many, this would seem like the ultimate market vindication.

However, tulips once traded for mansions.

Manias don’t die because sceptics speak up—they die because reality intrudes.

But this is not a market note. This is a reflection on value, belief, and what we, as investors and as human beings, choose to place our faith in.

As a free-market capitalist, I believe in the right of consenting adults to engage in speculation, commerce, and even folly.

A market, after all, exists whenever a willing buyer and seller meet. And crypto is undeniably a market — an extraordinarily popular one for speculation.

I’ve seen that first-hand through the use of the Vortex Indicator, the technical analysis tool I created, which is widely employed on crypto trading platforms around the world.

I respect the freedom of free people to engage in that. But this freedom must be coupled with clear-eyed awareness of what exactly we are participating in.

Because for all the hype, all the price action, and all the passion — crypto remains a belief system, not a financial system.

Invented Value, Worshipped Worthlessness

Crypto offers no intrinsic value. It generates no income. It has no cash flows, no utility, and no fundamental economic underpinning.

It is not a claim on any productive enterprise. It is not legal tender. It does not pay interest or rent. It is not a commodity in any classical sense.

It is, instead, a pure speculative instrument whose price is determined solely by collective sentiment — the Greater Fool Theory: the fervent conviction that someone, someday, will pay more for it than you did. It is pure abstraction, a digital token with no tether to reality beyond the belief that it is "the future."

This is not new. Humanity has always had a remarkable ability to construct belief systems around unseen, unproven forces. Religion, mythology, ideology — all are testaments to the human capacity for invention and faith. And like these, crypto is a construct. It exists because people believe it does.

No Use, Just Abuse

In the 17 years since the invention of Bitcoin — which makes it nearly as old as the iPhone, and older than Apple Pay — crypto has consistently promised, and failed, to deliver mainstream legal use cases. It is still not a widely used medium of exchange.

It has not meaningfully displaced fiat currencies. And it has not revolutionised payments or banking.

Instead, crypto has flourished where the law fails.

It is a tool of extortion, money laundering, and increasingly, political bribery. The most prominent and consistent applications of cryptocurrencies have been in ransomware attacks, anonymous transfers for criminal enterprises, and schemes designed to deceive and defraud the uninformed.

This isn’t incidental. This is the core of the industry.

Money-laundering and investor scams are not unfortunate behaviours that taint an otherwise promising innovation. They are the enterprise. Crypto has become the mechanism by which bad actors transfer wealth, hide funds, and lure in speculative capital from retail dreamers chasing outsized returns on thin air.

Whatever language future legislation uses to describe or regulate crypto, the result will still be the same: it will be enabling an enterprise that is, at its root, a vessel for deception.

Even as crypto’s criminal uses proliferate, it is currently gaining a surreal political¹ legitimacy.

The same U.S. administration whose First Family² reportedly profited from crypto promotions now floats the idea of a "crypto reserve"—an attempt to launder crypto’s reputation through state endorsement. This isn’t innovation; it’s regulatory capture by speculators, dressing up a speculative cult as national policy.

A Digital Religion, Built on Code

Crypto has all the characteristics of religion: prophets (crypto “thought leaders”), rituals (halvings, forks), temples (blockchain conferences), and a devout, often uncritical congregation.

It promises salvation — from centralised banks, from inflation, from the state — and offers freedom through belief. But unlike traditional religions, which at least claim moral or metaphysical guidance, crypto offers no such philosophy. It offers only price movement. And belief in price, unanchored to value, is a dangerous foundation for capital.

Yes, the blockchain may have utility in select areas — record-keeping, supply chains, digital verification.

But blockchain is a tool. Tokens are not. The conflation of the two is the magic trick that keeps the illusion alive.

Faith is not a strategy

At Alpha-Elite, we invest in reality.

Our capital is allocated exclusively to the two largest and most advanced economies in the world: the United States and Europe.

We focus on the world’s leading companies — those that build, heal, entertain, defend, and drive civilisation forward.

From life-saving biotechnology and global entertainment, to cement, infrastructure, aerospace, and defence systems used in the fight against global aggressors.

These are not promises; they are products. In a world seduced by digital illusions, we remain committed to investing in what is tangible, enduring, and real.

The Silver Lining: Human Ingenuity Unleashed

And yet — I do not end this criticism in despair.

Because, paradoxically, the very ability that allows mankind to construct myths, religions, and speculative manias… is the same brilliance that has birthed science, art, mathematics, medicine, and markets. The same imagination that dreams up false gods is also responsible for real breakthroughs.

Crypto is, in its own way, a testament to human creativity — just not one rooted in value. And while this particular belief system may collapse under its own weight, we should still admire the extraordinary capacity of the human brain to invent, organise, and convince.

That ingenuity is not always used wisely. But it is always awe-inspiring.

References:

1. The Crypto Industry Got What It Paid For - The Verge

2. The Real Trump Family Business Is Crypto - The Atlantic

May 6, 2025.

Artificial Intelligence and Hedge Funds – A False Promise?

In the year AD 2025, the first question we’re often asked as a quantitative momentum fund is:

Is Alpha-Elite an AI fund?

Before we answer that, it’s worth stepping back to ask a broader question:

Is artificial intelligence an existential threat to us—and to the hedge fund industry as a whole?

Revolution or Hype?

First, we need to distinguish how AI is actually used in finance.

Financial advisors, as one example, use it to sift through huge amounts of data and tailor solutions for clients. Some hedge funds, on the other hand, leverage AI to analyse company fundamentals, earnings calls, or masses of other financial information.

In all these cases, AI excels as a data processing assistant—not as the core of an investment strategy.

Unfortunately, the AI hype has also led to the phenomenon of “AI Washing” – where some unscrupulous participants in the industry simply pretend to be using AI, when in reality they are simply using basic quantitative techniques.

Then there are hedge funds built entirely around AI-driven strategies.

These use machine learning (ML) for algorithmic trading, pattern recognition, and predictive analytics. Techniques like random forests, ensemble learning, and neural networks attempt to uncover nonlinear relationships between data and price movements. Some even deploy reinforcement learning to evolve their strategies over time.

Sounds unbeatable, right? Not so fast.

The Reality: Mixed Results and Missed Expectations

Academic research and industry data paint a more sobering picture.

Yes, AI can help with risk management, trade execution, operational efficiency and processing vast information flows. Its speed may also give short-term traders an edge.¹ ² ³ ⁴

But when it comes to actual large-scale fund management returns, AI-driven funds have struggled to beat traditional benchmarks.⁵ ⁶ ⁷

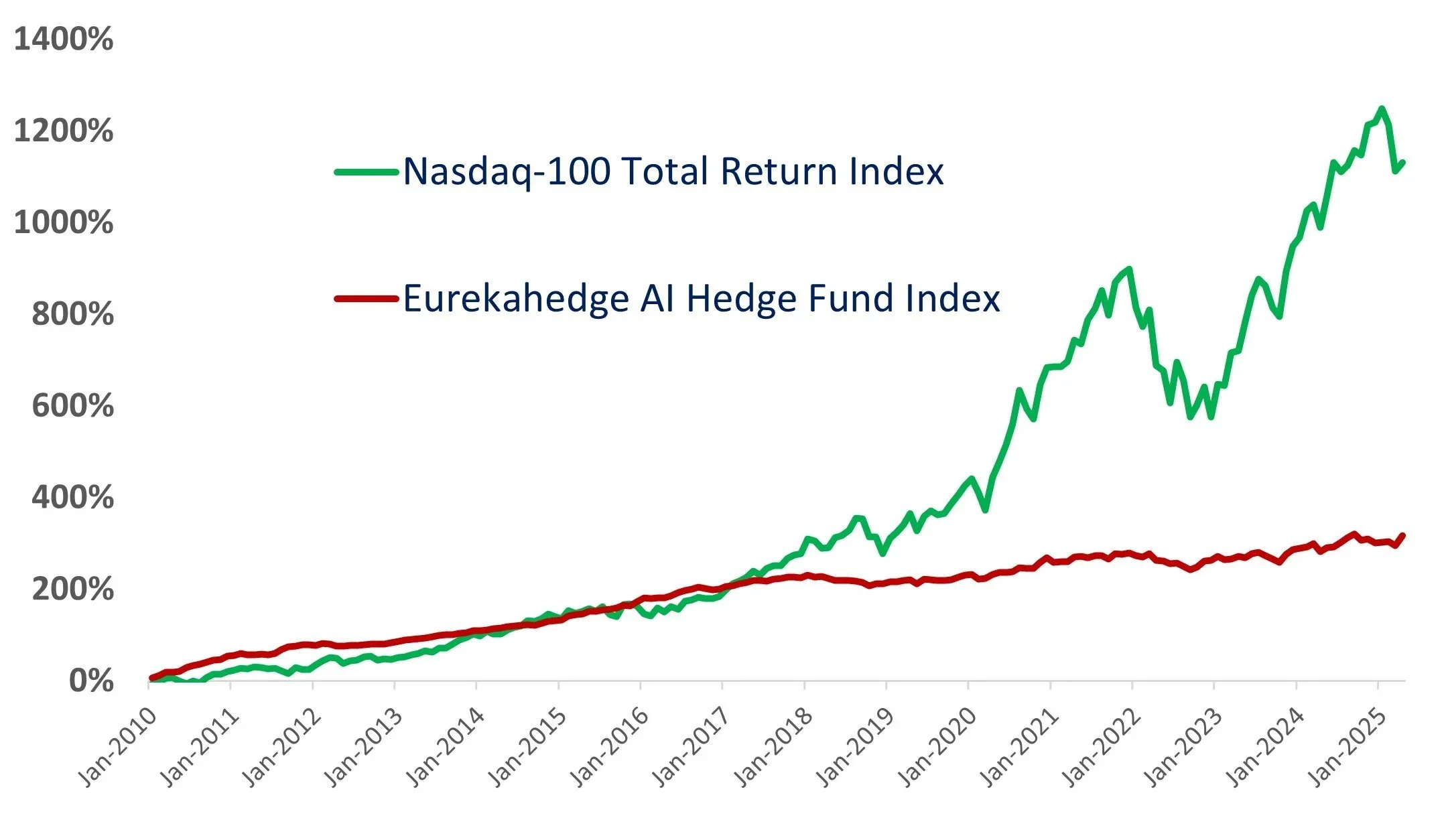

A 2021 review in the International Journal of Data Science and Analytics ⁸ analysed 27 peer-reviewed studies on AI in equity investing. It found that the Eurekahedge AI Hedge Fund Index ⁹ significantly underperformed the S&P 500 and MSCI World Indexes from 2011 to 2020.

AI versus the basic stock market…

…and what happens when Alpha-Elite Quantitative Momentum is added.

Their conclusion?

“There is no conclusive evidence of any ML-driven investment funds delivering spectacular returns at scale. All market data indicates substantial underperformance compared to benchmark indices.”

More revealing, Boczynski, Cuzzolin, and Sahakian wrote:

“The picture of real-world AI-driven investments is ambiguous and conspicuously lacking in high-profile success cases (while it is not lacking in high-profile failures).”

Our own observations mirror these findings.

AI is an invaluable tool in the investment process—especially for fundamental research, portfolio design, and operational support. But as a standalone investment strategy? The evidence is thin.

Our Experience with AI

So, have we tried AI ourselves in our momentum stock selection process?

Yes we have.

We experimented extensively with AI/ML to explore novel stock selection metrics. Using tools like XGBoost and SMOTE in Python / Jupyter notebooks on Google Colab, we analysed price and volume data from the Nasdaq 100 and S&P 100 to identify potential improvements.

The result? AI didn’t deliver. Despite rigorous testing, we found that AI could not generate any significantly new momentum signals. At best, it produced slight tweaks on already well-known metrics.

Why? Because AI lacks what still sets humans apart: creativity.

Intelligence does not equate to creativity.

And sometimes, creativity = weirdness.

Fortunately, we have weirdness in abundance.

Why Alpha-Elite Stays Human-Powered

We don’t see AI as a threat to our strategy, nor do we believe it offers a consistent edge in large-scale fund management.

Here’s why: AI models rely on historical data. If multiple funds use AI for momentum strategies, they’ll likely pick the same stocks, leading to overcrowded trades and reduced returns. The market becomes a hall of mirrors, reflecting the same signals.

Our quantitative momentum approach is grounded in rigorous research and the scientific method. Yet, human creativity remains our core. It’s what sets us apart in a world of algorithms.

The Twist: AI Could Fuel Our Wins

Here’s the fun part. Even if AI-driven funds proliferate, Alpha-Elite can still come out on top. If countless investors use AI to select stocks, their buying will create price movements. Our Allocation Engine, designed to detect momentum, will spot these trends and ride the wave. AI’s momentum behaviour becomes our opportunity.

The Human Element Still Wins

AI is a phenomenal tool, but it’s not a silver bullet for hedge fund success.

Our quantitative momentum strategy is rooted in the scientific method: observation, hypothesis, testing, iteration.

But at the core of Alpha-Elite is human ingenuity—the bold questions, the creative leaps, and yes, the occasional weird idea that works.

That’s not something you can automate.

References

1. Lopez de Prado, M. (2019) ‘Can Machines “Learn” Finance?’, The Journal of Financial Data Science, 1(1), pp. 10–21.

2. Zhang, Z., Zohren, S. and Roberts, S. (2020) ‘Deep Learning for Portfolio Optimization’, The Journal of Financial Data Science, 2(4), pp. 8–20.

3. Gu, S., Kelly, B. and Xiu, D. (2021) ‘Artificial Intelligence and Systematic Trading’, The Journal of Financial Economics, 141(2), pp. 641–666.

4. Agarwal, V. and Ren, H. (2023) ‘Hedge Funds: Performance, Risk Management, and Impact on Asset Markets’, Oxford Research Encyclopedia of Economics and Finance. Oxford University Press.

5. Bachelier, L. and Sornette, D. (2020) ‘Do Hedge Funds Use AI Effectively?’, The Journal of Portfolio Management, 46(4), pp. 56–70.

6. Harvey, C.R. and Liu, Y. (2021) ‘The Limits of Machine Learning in Hedge Fund Performance’, The Journal of Financial Data Science, 3(2), pp. 30–46.

7. Fabozzi, F.J. and López de Prado, M. (2022) ‘Artificial Intelligence in Asset Management: Hype or Reality?’, The Journal of Financial Data Science, 4(1), pp. 10–29.

8. Buczynski, W., Cuzzolin, F. and Sahakian, B. (2021) ‘A review of machine learning experiments in equity investment decision-making: why most published research findings do not live up to their promise in real life’, International Journal of Data Science and Analytics, 11(3), pp. 221–242.

9. https://platform.withintelligence.com/performance/indices/11793

May 1, 2025.

Pursuit of Perfection: Why Quant Investing Is Like Formula One

The world used to divide into two types of people: those who thought Formula One was mind-numbingly boring, and those who could recite engine specs on demand. Best avoid those at a dinner party.

Then Netflix changed the game. By distilling the drama—the rivalries, the personalities, the stakes—into a gripping series, they created a third group: a whole new audience who suddenly got it.

But there is another way to look at Formula One.

Beneath the glamour lies a masterclass in competitive edge. While “Drive to Survive” brought Formula One to mainstream audiences, its deeper value lies in the sport’s scientific core.

The Laboratory of the Track

Every Grand Prix is a live experiment. Engineers test hypotheses in real time: a redesigned front wing either cuts lap times or fails under Monza’s brutal curves. There’s no ambiguity—the stopwatch decides.

The best teams don’t win by luck. They win because they’re obsessed with process—shaving milliseconds through relentless iteration. A wing adjustment here, a suspension tweak there. Over a season, those micro-gains compound into dominance. Formula One is more than a sport—it’s a laboratory for relentless innovation.

The Adrian Newey Principle: Obsession Wins

I recently finished reading an autobiography called “How to Build a Car” by Adrian Newey.

Trained as an aerodynamicist, he became arguably the greatest race engineer ever, driving the success of teams like Williams, McLaren, and Red Bull.

His cars propelled drivers like Alain Prost, Mika Häkkinen, Sebastian Vettel, and Max Verstappen to World Championships.

His genius lay in refining minutiae—the angle of a rear diffuser, the curve of a bargeboard.

Each tweak alone meant little. Together, they made his cars unbeatable. Marginal gains create champions.

Sound familiar? It should.

Alpha-Elite as a Formula One Team

Our "races" unfold monthly. The competition? Benchmarks like the S&P 500 and Nasdaq-100 are the reigning champions most hedge funds struggle to beat.

Like an F1 team, we are constantly trying to come up with new ideas, new metrics and new methods to try to improve the performance of our momentum quantitative strategy.

The difference? We replay historical ‘races’ to stress-test every adjustment.

The massive advantage we have over Red Bull and McLaren is that we can go back in time and re-run every month’s race in different simulations — all 218 of them.

The Finish Line

By no means do we compare ourselves to the high-octane performance and glamour of Formula One – the real parallel is in the method: the relentless cycle of testing and improvement.

The Nasdaq-100 and S&P 500 might win some months (or even seasons). But like a top F1 team, we focus on the long term: over 3, 5, or 10 years, our incremental gains aim to outpace them.

Also, the reality check: while F1’s stakes could be life-and-death, at least a bad month for us isn’t going to wreck and destroy our car.

Therefore, Alpha-Elite isn’t just about raw monthly performance — it’s about the process. We optimise systems through a continued process of hypotheses, testing, tweaking, rejecting, and repeating—until only the strongest ideas survive.

And we’re getting better. One race at a time.